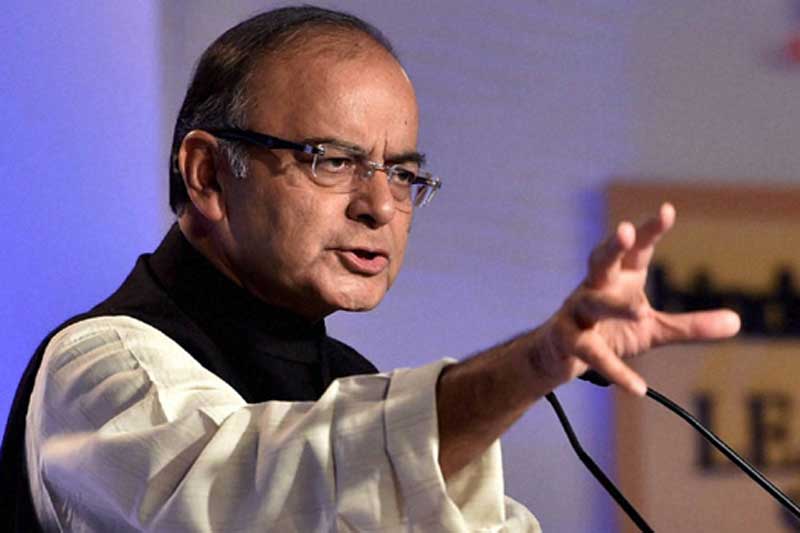

A four-tier tax structure has been proposed by the Finance Minister Arun Jaitley for the Goods and Service Tax (GST) in the third meeting of the GST council on Tuesday.

According to the GST bill, the tax rates vary from zero to 26 percent. The lowest slab is of 6 percent, two standard slabs rates are of 12 and 18 percent and the highest tax rate is of 26 percent.

Goods and services like food, health and education bears zero percent tax including the luxury foods such as FMCGs(Fast Moving Consumer Goods) and consumer durables. Other ultra luxury items like luxury cars and tobacco products will also carry a cess over the proposed 26 percent tax rate.

Essential services such as transportation are covered in the 12 percent slab while higher rate services that come under the Indirect Tax law will be subject to 18 percent tax. However, Gold is proposed to be taxed at 4 percent in the GST bill.

Around 70 percent of the taxable items are included either in the 6%, 12% or the 18% slab rate and the two slabs of 12 and 18 percent will alone cover more than 50 percent of the taxable items. Demerit goods such as tobacco, pan masala, luxury cars and aerated drinks form another 25 percent of taxable items that are covered under the 26 percent slab rate.

The revenue collections are estimated around 50,000 crores from the cess which is applicable on the luxury goods. However, around 26,000 crores from the above amount are expected to be collected through clean environment cess. The bill also proposed that the additional cess collections will only be used by Central Government to compensate the states.

The total estimated collections from the proposed GST bill are approximately Rs 8.72 Lakh Crores and the Inflation Rate based on the Consumer Price Index (CPI) is expected to be reduced by 0.06%.

This bill came as a relief as to the mango people because last year, a committee headed by Chief Economic Adviser, Mr. Arvind Subramanian recommended the tax rates of 15-15.5%(now 12%), 16.9-18.9%(now 18%) and a humungous rate of 40%(now 26%) on the high-end luxury items.

Follow us on Facebook, Twitter and Instagram for more updates. Don’t forget to like and share. Do tell us your views in the comment box below.

19 October 2016

Rohan Jaitly

Thanks for sharing important update on GST Rates